European Union energy ministers have backed the bloc’s proposals to phase out imports by January 2028. The EU wants to gradually phase out Russian oil and gas imports in an effort to “deprive the Kremlin of the revenue it uses to finance the war” in Ukraine.

The punitive measures are considered temporary and could be lifted when the war in Ukraine is over and Brussels no longer sees a reason to impose them.

Imports plummet

The amount of oil and gas that Europe (EU) buys from Russia has fallen drastically over the past four years (2021-2024), as a result of the Russian invasion of Ukraine and the subsequent European sanctions and the strategy of de-dependence.

In 2021, Russia supplied the EU with with about 45% of its natural gas. Within three years, this figure has fallen to about 19%. The decline is mainly due to the interruption or significant reduction of pipeline flows (e.g., Nord Stream) and the EU’s efforts to diversify supply sources (e.g., Liquefied Natural Gas – LNG from other countries, mainly the USA).

In 2021, Russia supplied the EU with about 27% of its oil. This figure has fallen to about 3% in 2024. The decline is a result of European sanctions, which include a ban on seaborne imports of Russian crude oil and petroleum products.

Despite the drastic reduction, some quantities of Russian natural gas (through the remaining pipelines, such as TurkStream) and, to a lesser extent, oil (due to exemptions/derogations from sanctions for certain member states or indirect imports) continue to be imported into the EU.

Added to this is the ongoing pressure from US President Donald Trump on NATO members to stop buying Russian energy.

Europe is the fourth largest buyer of Russian fossil fuels

According to the Center for Research on Energy and Clean Air (CREA) (“September 2025 — Monthly analysis of Russian fossil fuel exports and sanctions“), in September 2025, Russia’s monthly revenue from fossil fuel exports fell 4% compared to the previous month, to 546 million euros (million) per day – the lowest level they have reached since the invasion of Ukraine.

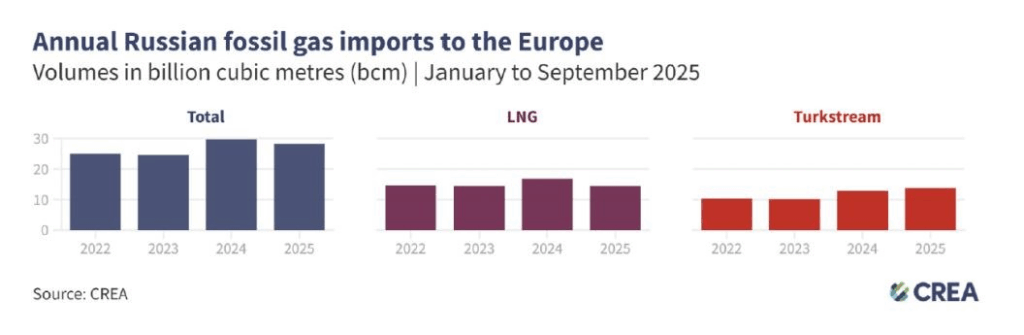

Russian gas supplies to Europe via TurkStream increased by 7% year-on-year this year, with 13.8 billion cubic meters (bcm) delivered in the first three quarters of 2025.

The EU was the fourth largest buyer of Russian fossil fuels, accounting for 8% (€1 billion) of Russia’s revenues. The majority of imports, 70% (€743 million), consisted of liquefied natural gas and pipeline gas, followed by crude oil at 29% (€311 million).

Europe remains the largest buyer of Russian liquefied natural gas (LNG) and has purchased half of Russia’s total liquefied natural gas exports, followed by China (22%) and Japan (18%).

It remains the largest buyer of natural gas (via pipelines), buying 35% of Russian gas, followed by China (30%) and Turkey (29%).

The same is not true for oil. Europe imports only 6% of Russian oil, with China having bought 47% of crude oil exports, followed by India (38%).

Turkey was the third largest importer of Russian fossil fuels, accounting for 20% (€2.6 billion) of Russia’s export earnings.

The “five” with the largest imports

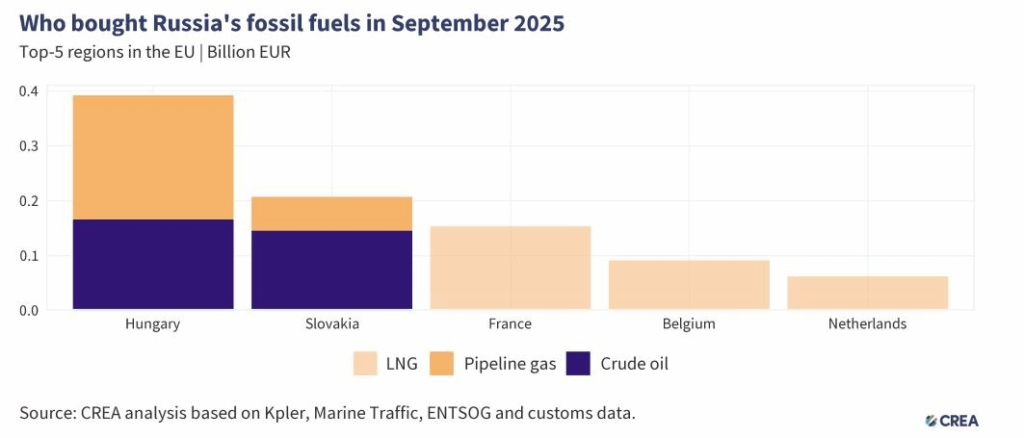

In September 2025, the five largest importers of Russian fossil fuels to the EU paid Russia a total of €906 million for fossil fuels. Two-thirds of these imports were natural gas, which was mainly delivered via pipelines or as liquefied natural gas (LNG). The rest was largely crude oil, which continues to flow to Hungary and Slovakia via the southern branch of the Druzhba pipeline.

Hungary was the EU’s largest importer, buying €393 million worth of Russian fossil fuels. This included €166 million worth of crude oil and €226 million worth of pipeline gas.

Slovakia was the second largest importer, with imports totalling €207 million. Crude oil delivered via the Druzhba pipeline accounted for 70% of the total (€145 million), while pipeline gas accounted for €62 million.

France was the third largest buyer, importing €153 million worth of Russian fossil fuels, all in the form of liquefied natural gas. However, not all of this gas is consumed domestically – a study shows that some of what enters via the Dunkirk terminal is then delivered to Germany.

Belgium was the fourth largest importer, importing €92 million of Russian LNG, while the Netherlands, in fifth place, bought €62 million, also entirely in LNG.