The fact that the Chinese economy came out very quickly from the spread of the pandemic and in particular in the first three months of 2020, managing to revoke all the imposed measures of lockdown and social isolation, justifies as a point the ever-increasing expectations of investors to invest in China, despite the well-known pathologies that characterize Chinese stock exchanges, cumulatively worth $9.5trillion.

By Trust Economics-https://trusteconomics.eu

©The law of intellectual property is prohibited in any way unlawful use/appropriation of this article, with heavy civil and criminal penalties for the infringer.

The role of the Central Bank of China

The People’s Bank of China (POBC) has so far avoided imposing a restrictive monetary policy. Its firm choice is to implement a quantitative easing policy. It prefers to relax on an ongoing basis the capital adequacy rules of Chinese banks with the aim of then forcing them to increase the funds allocated to lending.

In addition, despite the large debt of local governments (authorities) in China’s provinces, it allowed them to increase their borrowing.

The aim of this generalised and increased liquidity is to curb the rate of bankruptcies of high-rate lending companies while financing consumption to contain the fall in GDP caused by both the Covid-19 pandemic measures and the restriction of Chinese exports due to the trade war with the US.

To meet the cost of the pandemic, China has delivered special types of government bonds.

The characteristics of the rapid rise of Chinese stock markets

So the ample liquidity, the constant propaganda of the state authorities which lies in the systematic and chronic invitation to investors everywhere to buy shares of Chinese companies as well as the limitless speculation are the main characteristics, in which the stock markets moved upwards and rapidly during the first fifteen days of July.

But the problem that is gradually emerging is the high probability that a stock market bubble in Chinese stock markets will emerge in the near future and in 2020, while this growing abundance of liquidity is supported and encouraged by the Chinese Government.

So extensive government-led borrowing is not directed towards investments in China’s real economy, for example in industry, technology, etc., to create new jobs and given the restriction of Chinese exports.

The returns on investments in China’s real economy are much lower than the corresponding returns that an investor can derive by investing in the stock market and in particular in the shares of Chinese companies and since the degree of risk is the same quantitatively in both types of investments.

The Bubble

Today, lending to buy shares in China has reached its highest level since 2015 to date. But this practice poses risks for investors because they follow as-herd/crowd the general climate that exists by ignoring both the fundamentals of the Chinese listed companies in which they invest their money and the fundamental macroeconomic data of the Chinese economy, setting aside the real risk of losing their money in a short period of time if the market turns against them.

The crazy rise in speculation is condensed into the fact that China’s stock markets have increased their value by about $1trillion in a single week.

Today’s whole thing is strongly reminiscent of the spectacular stock market rise of Chinese stock markets, which caused the then “bubble” to break and subsequently fall in 2015. If a new bubble bursts, it will cause severe twisting in the global economic system.

US and EU

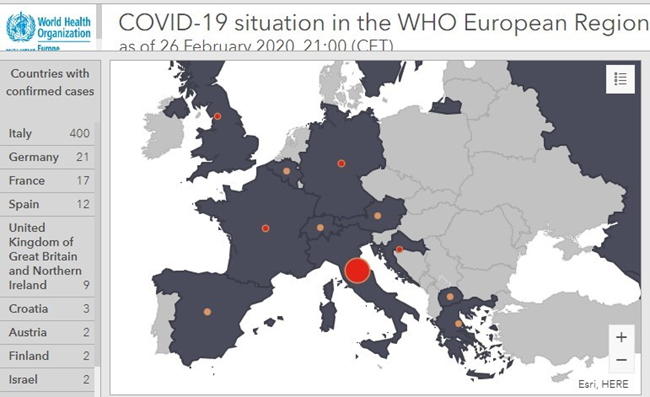

At the same time, with the rise of Chinese stock markets, US and EU stock markets moved upward for the same period. These stock market rises were based on the news made public and indicated that by mid-October the vaccine for Covid-19, which has so far hit the world’s major economies, will have been found.

But expectations and the real events are different. Until an effective remedy is found for Covid-19, the US and EU Central Banks equally should not increase the liquidity granted, because this liquidity will not be directed to the real economy and as it should in order for their economies to escape the recession, but to stock market investments that at present can yield higher returns at lower levels of investment risk and with a high probability that this liquidity provided will be directed abroad (e.g. China).